401k Max 2025 Roth Conversion. The cap applies to contributions made across all iras you might have. This is an extra $500 over 2025.

Less than $146,000 if you are a single filer. The exception to this would be if an account owner turned rmd age in 2025 and waited until 2025 to take their first rmd.

Eligibility For Roth Ira 2025 Ania Meridel, But that “if” is big. If you’re a single filer, you’re eligible to contribute a portion of the full amount if your magi is $146,000 or more, but less than $161,000.

What is a 401(k) InPlan Roth Conversion, The cap applies to contributions made across all iras you might have. Less than $146,000 if you are a single filer.

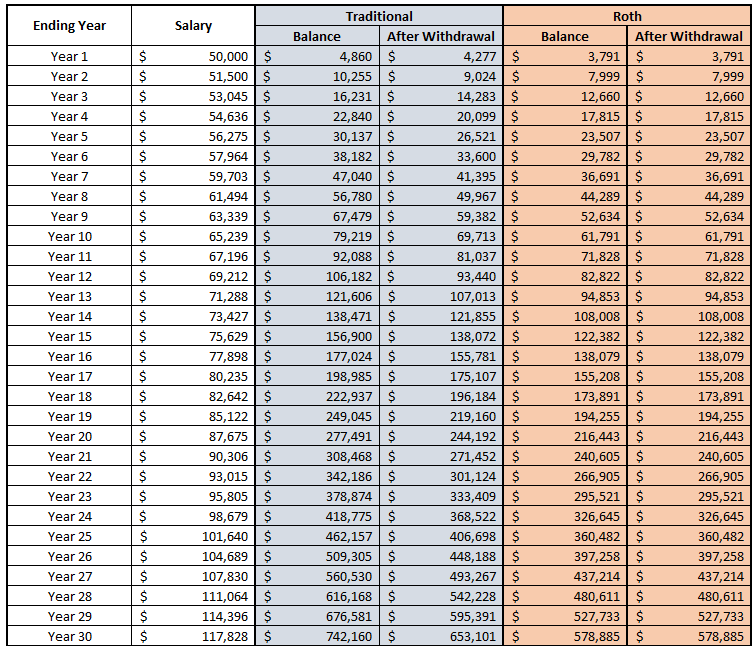

Optimize Your Retirement With This Roth vs. Traditional 401k Calculator!, For more detail, see converting your traditional ira to a roth ira which includes a roth conversion tool and a checklist. The maximum amount you can contribute to a roth 401 (k) for 2025 is $23,000 if you're younger than age 50.

What Is a Roth 401(k)? Here's What You Need to Know theSkimm, The exception to this would be if an account owner turned rmd age in 2025 and waited until 2025 to take their first rmd. Less than $230,000 if you are married filing jointly or a qualifying widower.

401k 2025 Contribution Limit Chart, But unlike a standard roth ira conversion, you do. To max out your roth ira contribution in 2025, your income must be:

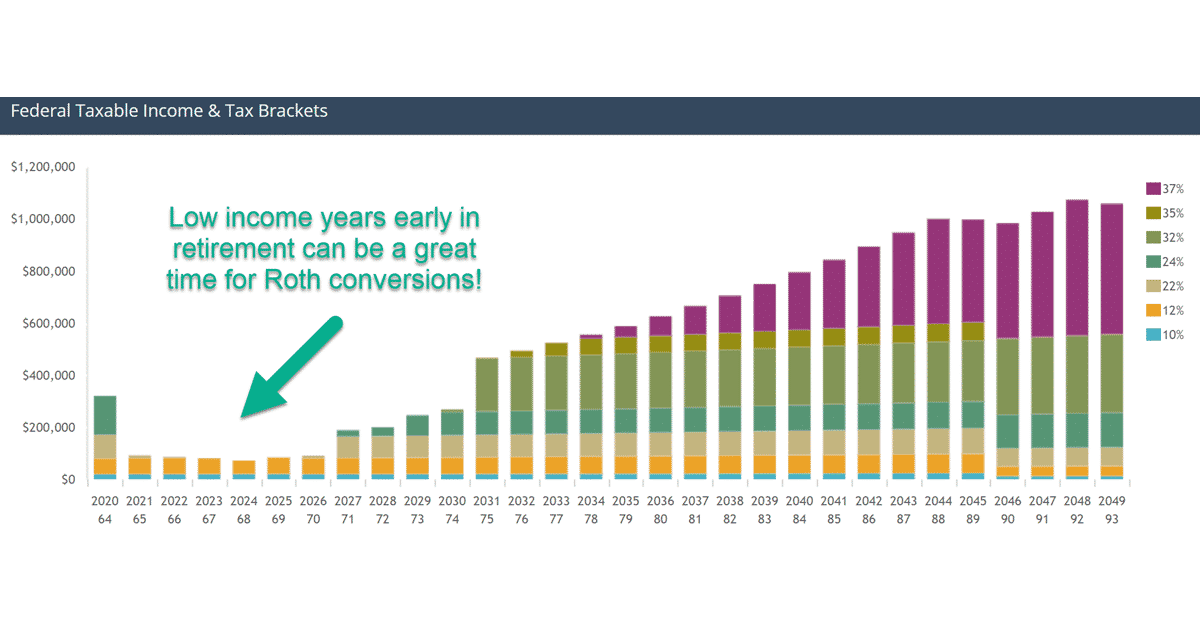

Guide to Roth Conversions Why, When, and How Much to Convert, The money moved into the roth will be taxable as income in the year of the conversion, so the hope is that you’ll save more in taxes from later roth distributions than you’re paying in taxes now. A roth conversion is when you transfer money from a traditional ira to a roth ira.

Building a Roth Conversion Ladder Retirement Nerd, The more money you’ve saved in an individual retirement account or a 401(k), the more you. The 2025 limit was $22,500.

Max 401k Contribution 2025 Roth Belva Kittie, This credit is a dollar. Not opening a roth because you already have a 401 (k) there are two main types of retirement savings accounts:

Your Guide to Roth Conversions Kiplinger, The cap applies to contributions made across all iras you might have. People under age 50 can generally contribute up to $7,000 per year to their roth iras.

What Is Roth 401K Limit For 2025, But unlike a standard roth ira conversion, you do. Is converting to a roth ira the right move for you?

Roth individual retirement account conversions are up in 2025 — but there are key things to know before converting funds, experts say.